Now is the time to cancel student debt, Democrats say

With America bracing for a possible financial collapse in the face of the ongoing coronavirus pandemic, lawmakers are scrambling to put the finishing touches on a $2 trillion relief package that would — in theory at least — help keep people and businesses temporarily solvent while the worst of the crisis forces the country to drastically pivot into uncharted social and economic territory. The government has also taken action to stave off certain financial burdens and consequences, like evictions, and some Democrats say that the spread of coronavirus should translate to student loan forgiveness too.

There's plenty in the proposed relief package — which, at the time of writing, is being debated on the House floor — to suggest that whatever ends up passing will be more of a Band-Aid than a panacea for the unprecedented impact the coronavirus has had, and will continue to have, on our lives. But among the better things the bill addresses is the need to alleviate the crushing weight of student debt — a $1.6 trillion dollar affliction for more than 7% of the entire country.

Among the things the relief bill would do is provide an extended moratorium on paying off federal student loans through the end of September, as well as waive interest on those loans during the same period and suspend debt collection during this time. It also incentivizes businesses to help pay off employees' student loan debt — even debt incurred before the person worked at the company — by allowing employers to contribute up to $5,250 this year, tax-free.

That's a start, but it's important to point out that the measures covered in this stimulus bill apply solely to federal loans, not private ones. And most importantly, the package doesn't actually cancel any debt — instead, it just pushes payments off a few months, in the hopes that people will be financially sound enough to happily slip the student loan yoke back on their shoulders when this is all (hopefully) done.

Put simply, for the roughly 45 million Americans whose student loan debt was a crushing burden before coronavirus upended everything, the bill offers nothing more than a temporary break, rather than permanent relief.

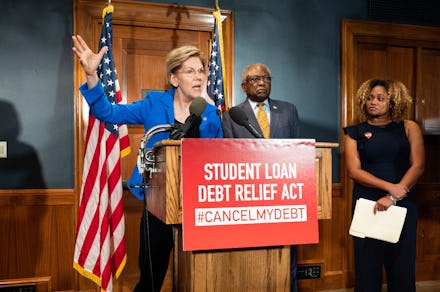

Leading the charge to use the pandemic as an opportunity to truly help people, while simultaneously stimulating America's floundering economy, is former presidential candidate Elizabeth Warren, who has called to fully cancel at least $10,000 of federal student loan debt per borrower. It's a move the Massachusetts senator claims would not only make the individual borrowers' lives better, but would ultimately help pour money back into the economy itself — and some economists have affirmed her theory.

As a team of researchers from Brandeis University concluded in a letter posted to Warren's website:

The greater ability to save and build assets entailed by a lower debt load would generate additional wealth and would be significant in the lives of debtors. It would likely entail consumer-driven economic stimulus, improved credit scores, greater home- 3 buying rates and housing stability, higher college completion rates, and greater business formation.

In other words, the less you spend on student loan payments, the more you can spend on important things, like houses, education, and starting businesses. It's a move that presumptive Democratic presidential nominee Joe Biden has also endorsed as part of his late-to-the-game pandemic response.

Other national Democrats, like Minnesota Rep. Ilhan Omar and Massachusetts Rep. Ayanna Pressley, have echoed the call to cancel student debt right now. Bernie Sanders, the Vermont senator who is still facing off against Biden for the nomination, has proposed waiving all student loan payments "for the duration of the emergency," plus one month after.

Considering that the government is lending a whopping $1 trillion every day to help keep banks afloat during this crisis, the idea that student loans should also be forgiven — especially given what that could do to help jumpstart the economy, in addition to the human benefit — sounds more and more appealing by the day.